Suffering to regulate your budget successfully? Feeling beaten by means of budgeting, making an investment, and discovering techniques to extend your source of revenue?

You’re now not on my own. Many face those demanding situations, particularly in as of late’s fast paced monetary panorama. However right here’s the excellent news: mastering those talents is inside your succeed in.

On this article, we’ll discover 10 actionable activates designed that can assist you take keep watch over of your budget, make knowledgeable funding choices, and uncover new source of revenue alternatives.

Via enforcing those methods, you’ll be nicely for your technique to monetary talent in 2025.

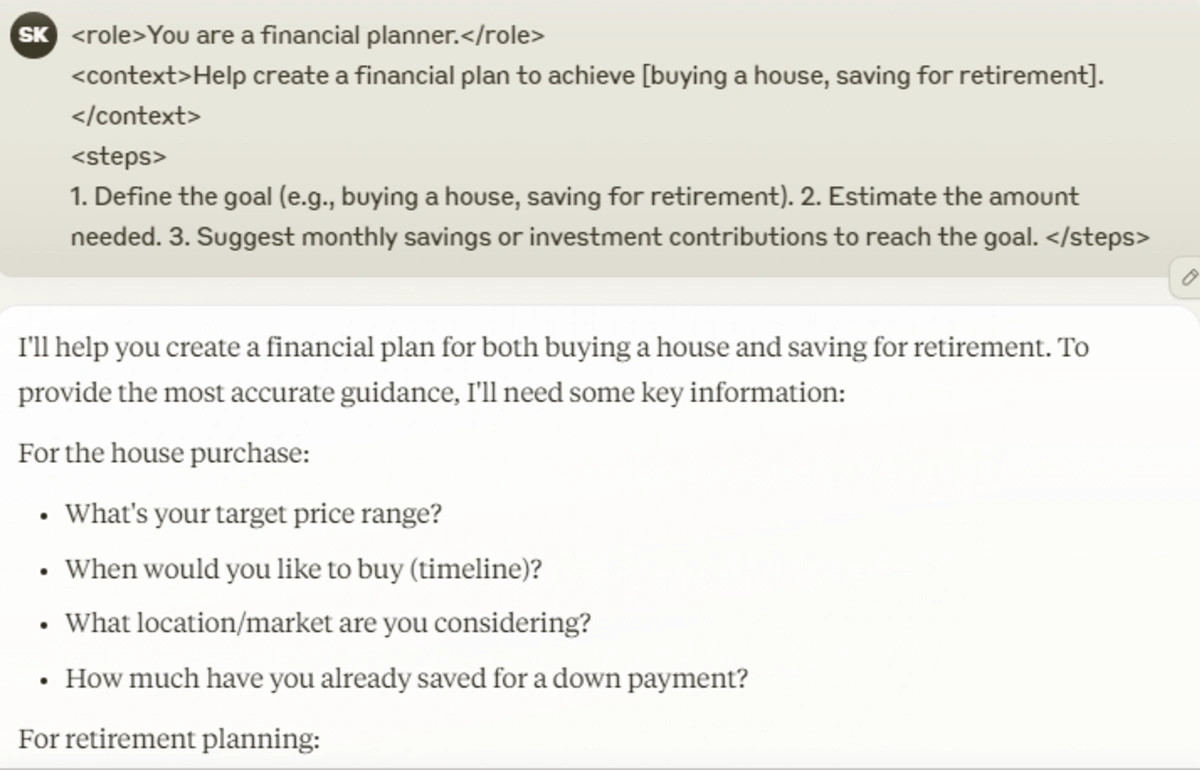

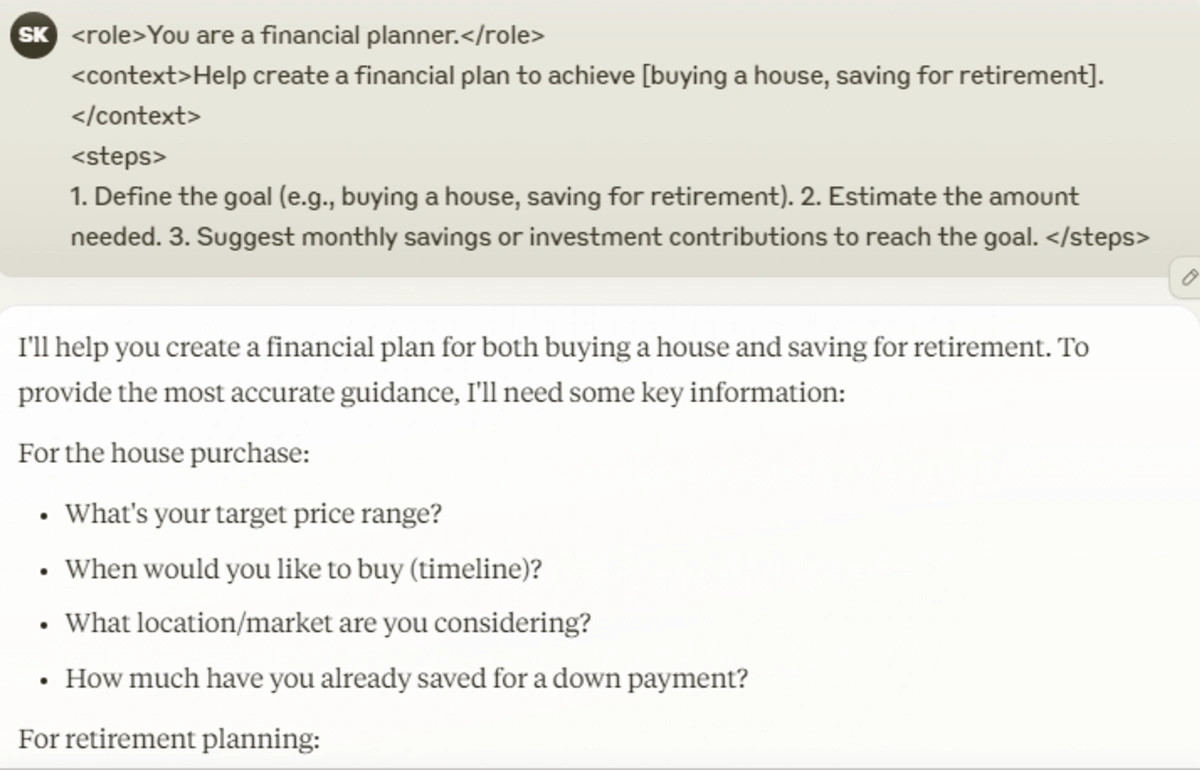

1. Monetary Function Setter

Organising transparent monetary targets is very important for attaining financial balance and luck. Determine explicit goals, reminiscent of buying a house, investment schooling, or construction an emergency fund.

Assess your present monetary scenario to grasp your start line. Determine a practical timeline and resolve the essential financial savings or investments to succeed in your goals. Frequently observe your growth and alter your plan as had to keep on target.

Suggested:

- Outline the function (e.g., purchasing a area, saving for retirement).

- Estimate the quantity wanted.

- Counsel per 30 days financial savings or funding contributions to succeed in the function.

3/ Monetary Function Setter

Suggested:

You’re a monetary planner. Lend a hand create a monetary plan to reach [INSERT GOAL]. 1. Outline the function (e.g., purchasing a area, saving for retirement).

2. Estimate the quantity wanted.

3. Counsel per 30 days… percent.twitter.com/pI0A6E24RL— God of Suggested (@godofprompt) January 12, 2025

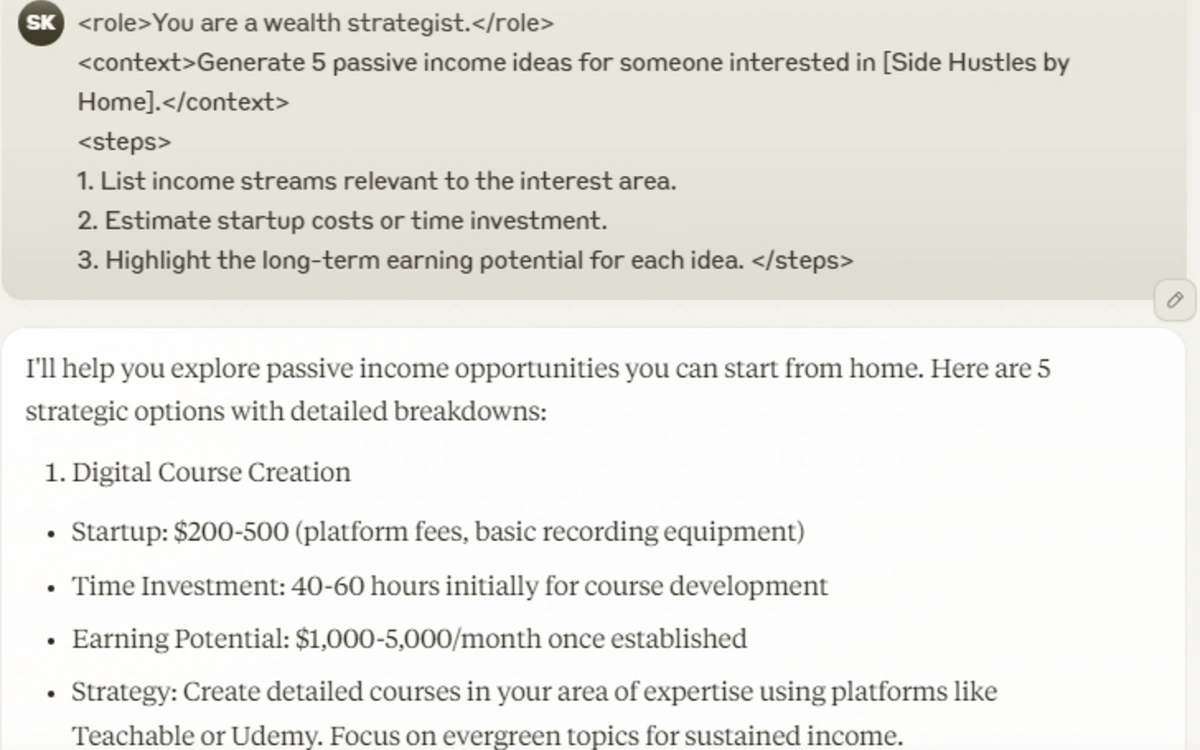

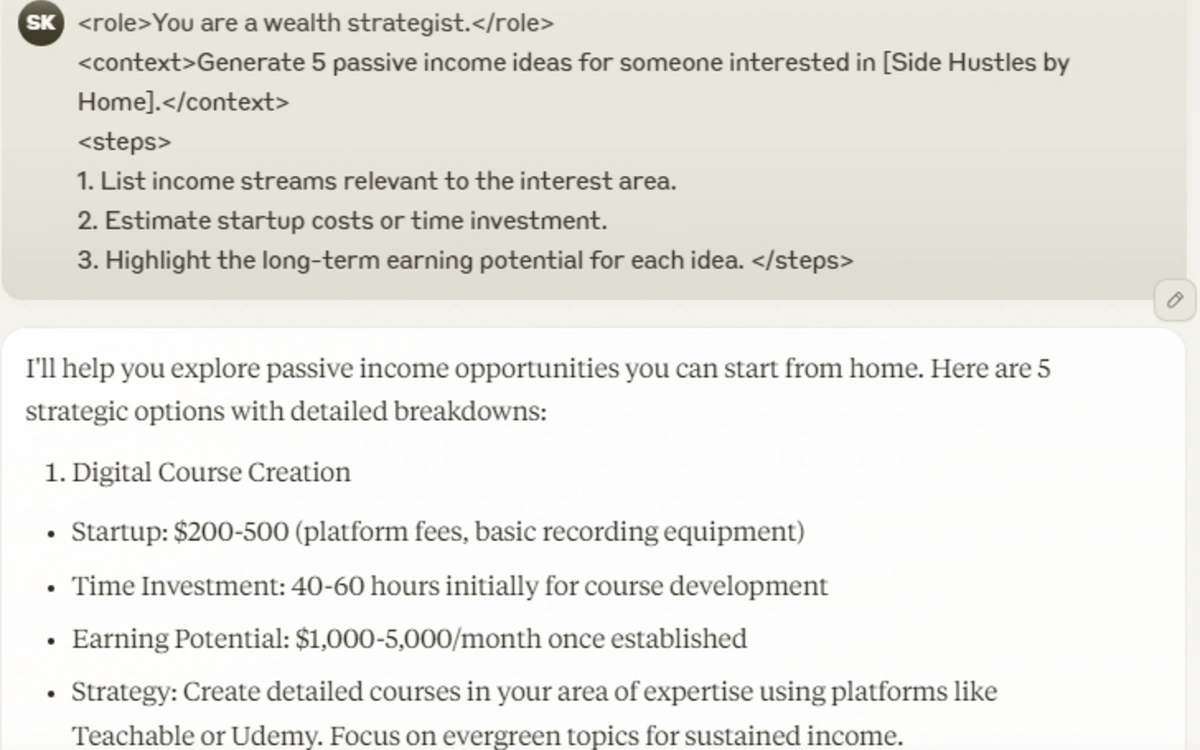

2. Passive Source of revenue Concepts

Diversifying source of revenue streams complements monetary balance. Believe passive source of revenue alternatives that align together with your pursuits and talents. Choices come with apartment houses, dividend-paying shares, or developing virtual merchandise.

Review the preliminary funding, time dedication, and doable returns for every thought. Imposing a couple of source of revenue assets may give monetary safety and boost up wealth accumulation.

Suggested:

- Record source of revenue streams related to the hobby house.

- Estimate startup prices or time funding.

- Spotlight the long-term incomes doable for every thought.

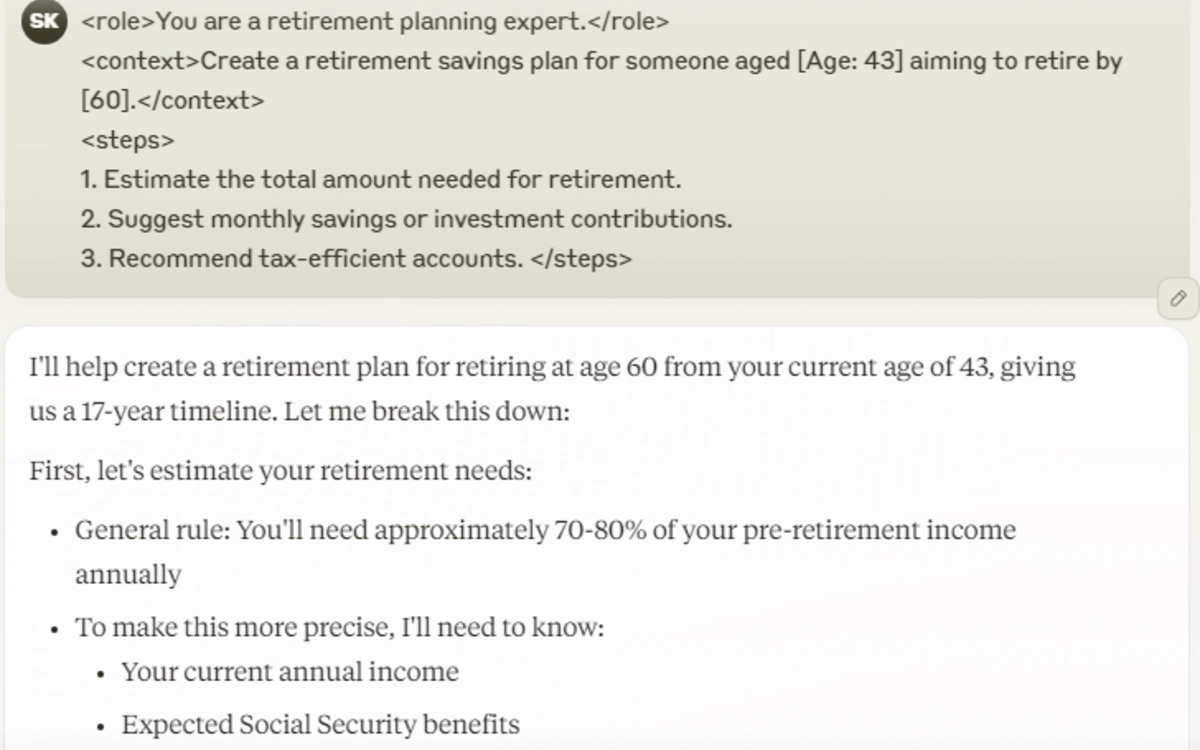

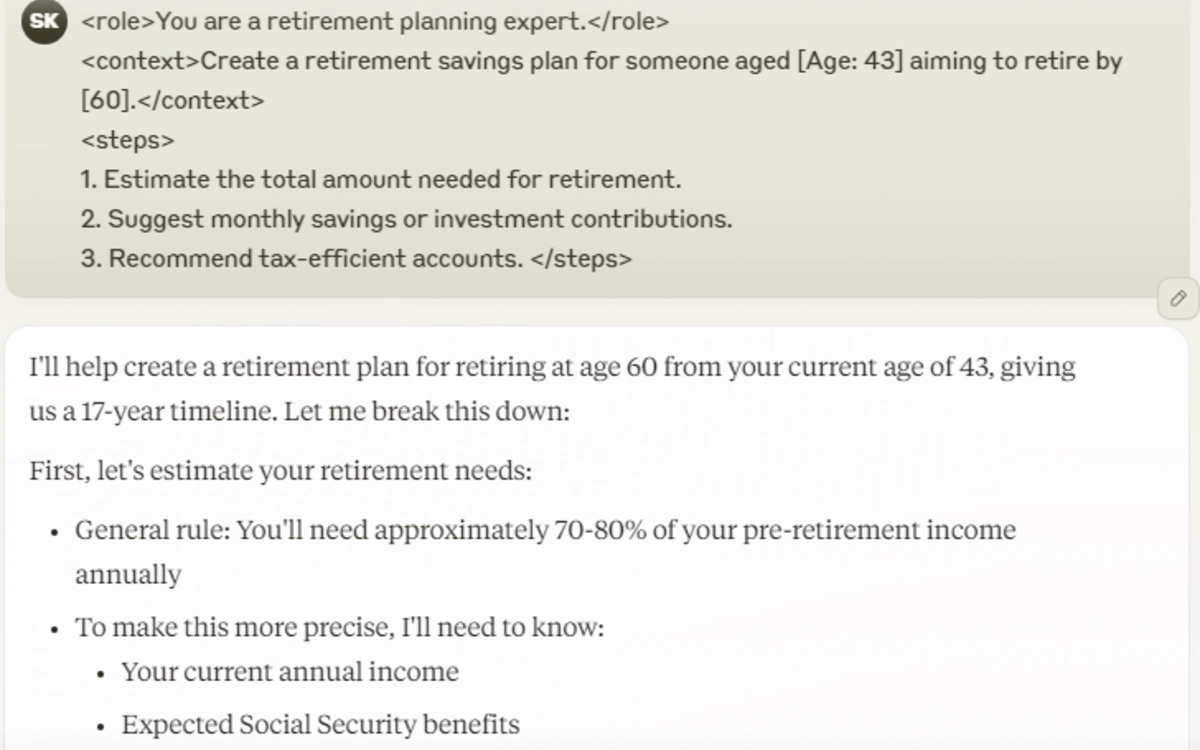

3. Retirement Financial savings Planner

Making plans for retirement is very important for long-term monetary well-being. Get started by means of estimating the entire quantity had to deal with your required way of life post-retirement. Believe elements like existence expectancy, healthcare prices, and inflation.

Decide the age at which you goal to retire and calculate the per 30 days financial savings required to reach your function. Make the most of tax-advantaged retirement accounts to maximise your financial savings. Frequently overview and alter your plan to house adjustments in source of revenue or monetary priorities.

Suggested:

- Estimate the entire quantity wanted for retirement.

- Counsel per 30 days financial savings or funding contributions.

- Counsel tax-efficient accounts.

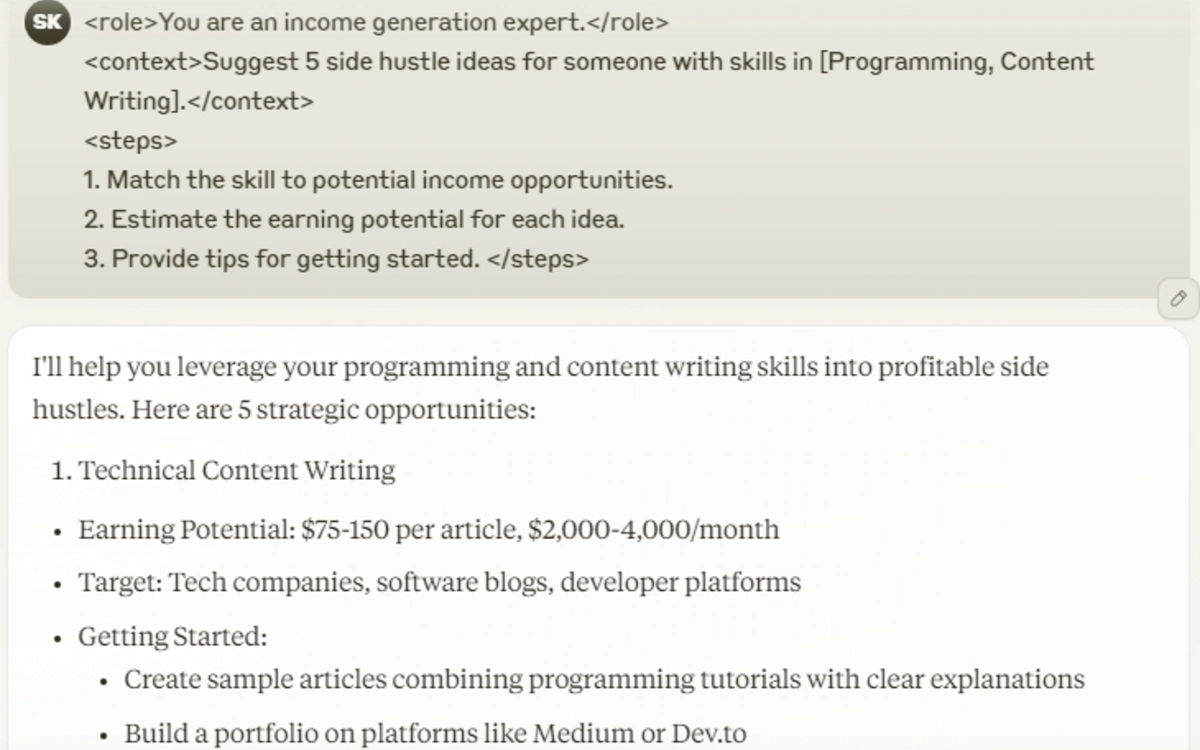

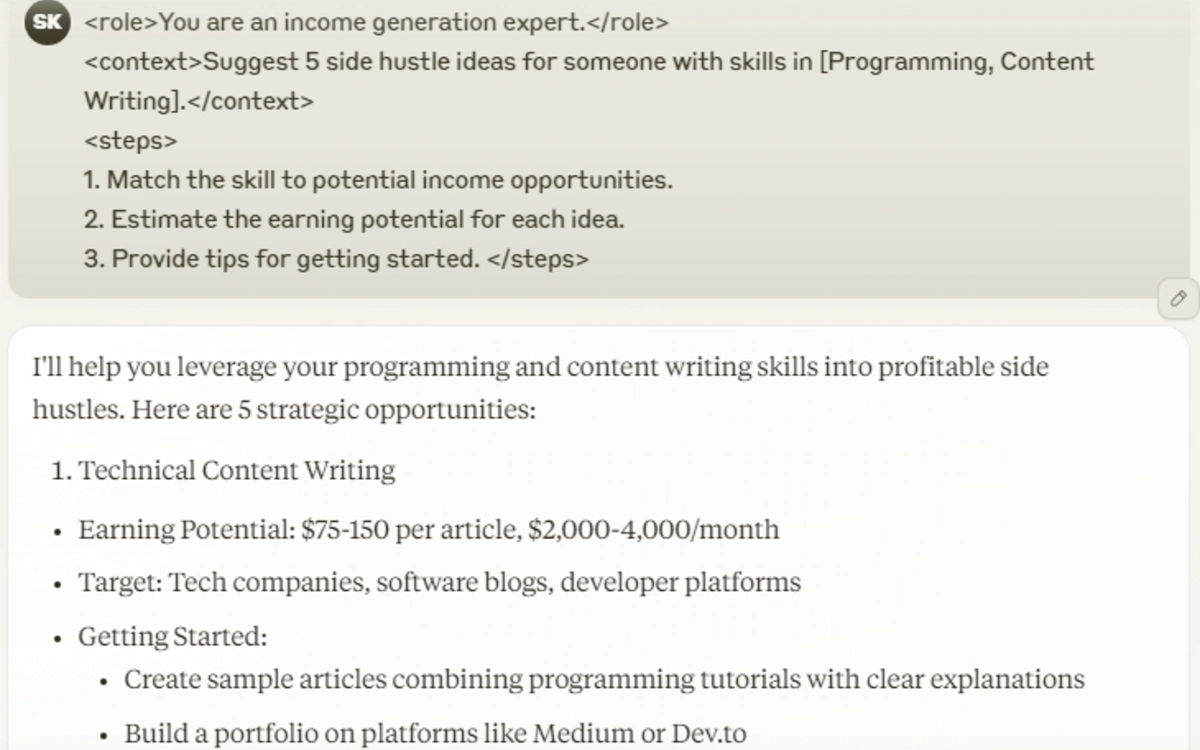

4. Facet Hustle Strategist

Exploring aspect hustles can spice up your source of revenue and expedite monetary function attainment. Determine talents or leisure pursuits that may be monetized, reminiscent of freelance writing, graphic design, or tutoring.

Analysis marketplace call for and doable income for every possibility. Beginning small lets you check the viability of your aspect hustle with out important menace. Over the years, a a success aspect hustle can turn out to be a considerable source of revenue supply, offering further monetary flexibility.

Suggested:

- Fit the talent to doable source of revenue alternatives.

- Estimate the incomes doable for every thought.

- Supply guidelines for buying began.

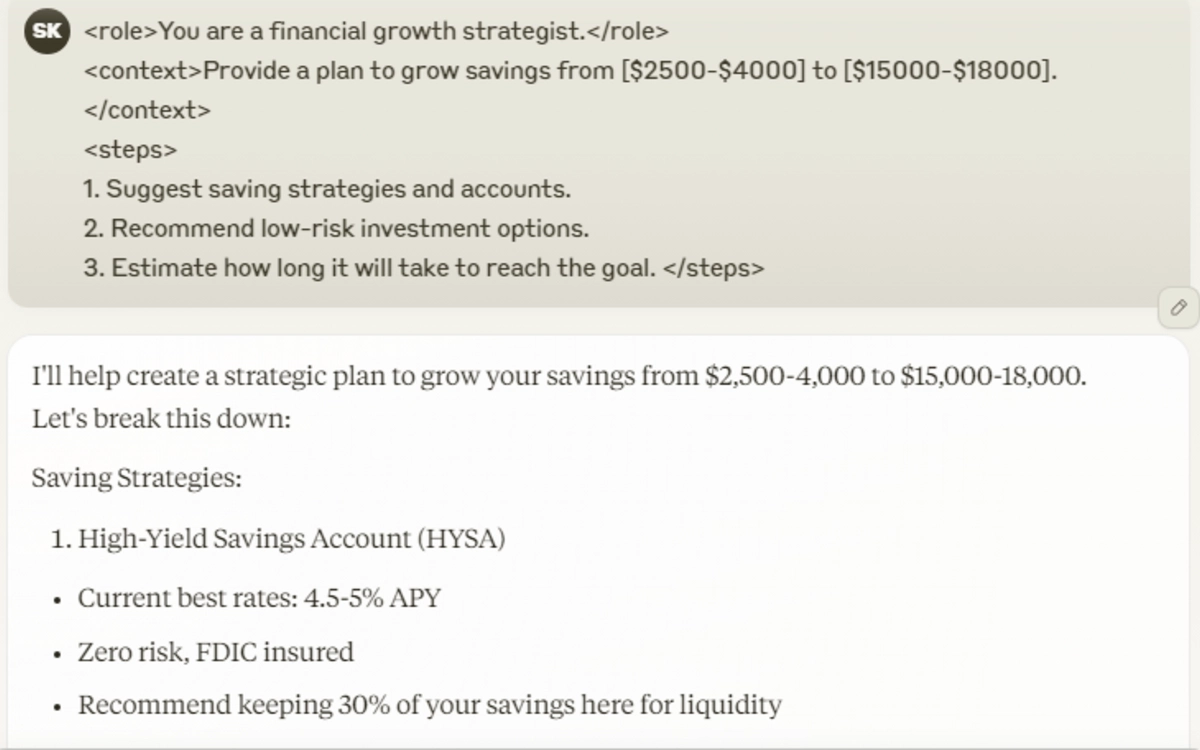

5. Financial savings Enlargement Guide

Rising your financial savings calls for strategic making plans and disciplined execution. Start by means of environment a transparent financial savings function and organising a practical timeline. Put into effect the cheap to spot spaces the place bills can also be lowered, redirecting the ones finances into financial savings.

Believe low-risk funding choices to strengthen expansion doable. Frequently overview your growth and alter your methods as had to keep aligned together with your goals.

Suggested:

- Counsel saving methods and accounts.

- Counsel low-risk funding choices.

- Estimate how lengthy it’s going to take to succeed in the function.

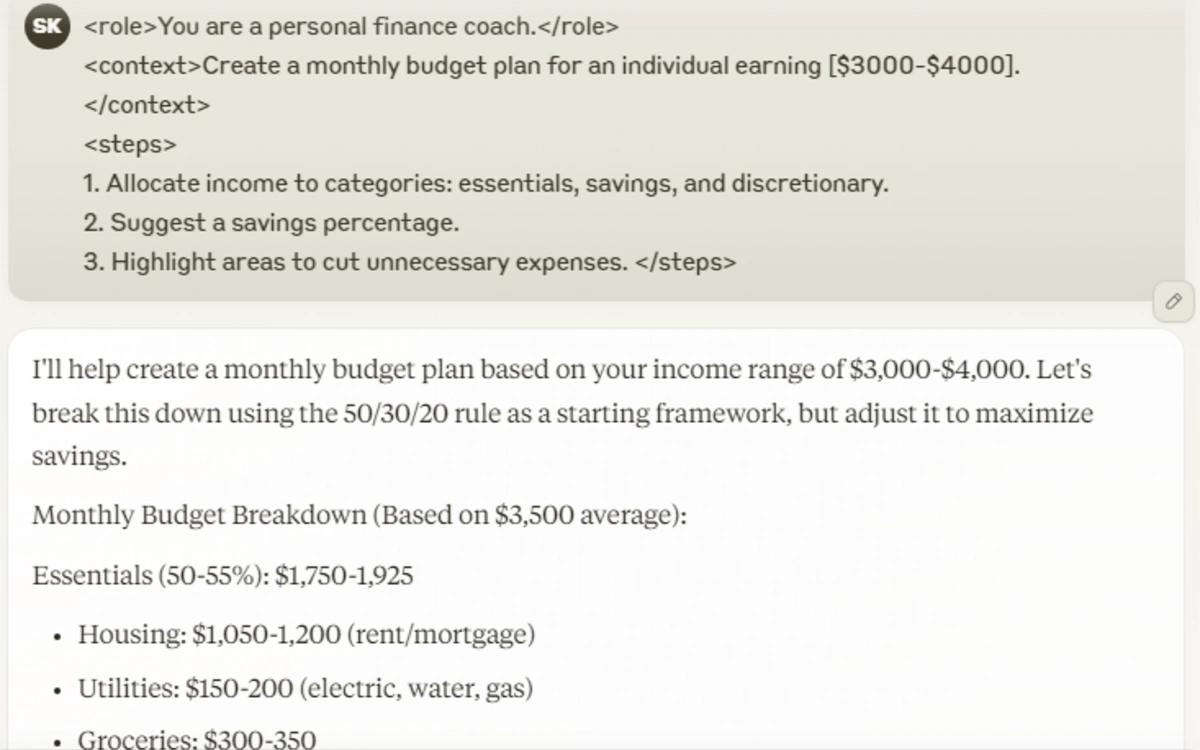

6. Private Funds Planner

Growing a non-public price range is very important for managing your budget successfully. Start by means of calculating your internet source of revenue, which contains your wage and any further source of revenue assets. Subsequent, monitor your per 30 days bills, categorizing them into necessities (like hire and groceries), discretionary spending, and financial savings.

This procedure is helping establish spaces the place you’ll scale back spending and allocate extra in opposition to financial savings or debt compensation. Using budgeting equipment or apps can simplify this process and supply visible insights into your spending conduct. Frequently reviewing and adjusting your price range guarantees it stays aligned together with your monetary targets and adapts to any adjustments for your source of revenue or bills.

Suggested:

- Allocate source of revenue to classes: necessities, financial savings, and discretionary.

- Counsel a financial savings proportion.

- Spotlight spaces to chop pointless bills.

1/ Private Funds Planner

Suggested:

You’re a non-public finance trainer. Create a per 30 days price range plan for a person incomes [INSERT INCOME]. 1. Allocate source of revenue to classes: necessities, financial savings, and discretionary.

2. Counsel a financial savings… percent.twitter.com/FSBgUEY2GA— God of Suggested (@godofprompt) January 12, 2025

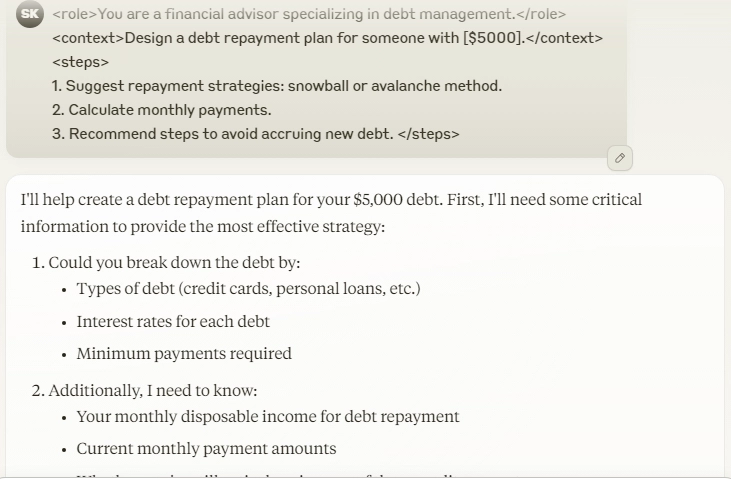

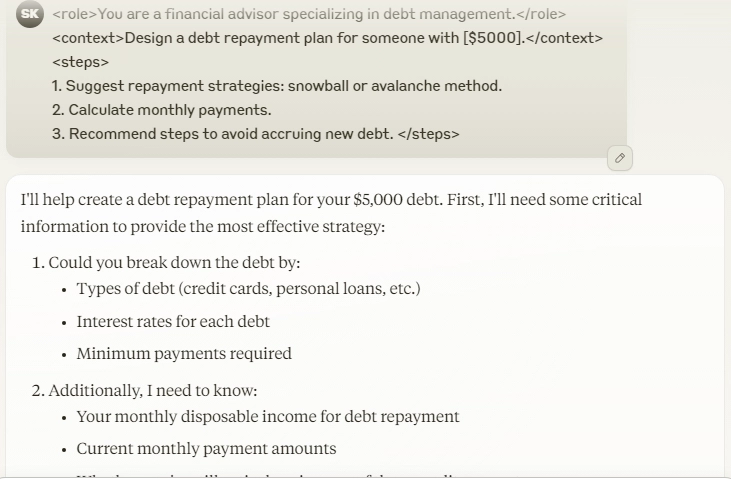

7. Debt Reimbursement Guide

Successfully managing and repaying debt is a very powerful for monetary well being. Get started by means of list your entire money owed, together with balances, rates of interest, and minimal bills. Two standard methods for compensation are the snowball and avalanche strategies.

The snowball manner makes a speciality of paying off the smallest money owed first to construct momentum, whilst the avalanche manner goals money owed with the best possible rates of interest to attenuate prices through the years. Make a choice the manner that most nearly fits your persona and monetary scenario.

Moreover, steer clear of accruing new debt by means of curtailing pointless spending and that specialize in residing inside your way. Frequently tracking your growth can stay you motivated and on target towards changing into debt-free.

Suggested:

- Counsel compensation methods: snowball or avalanche manner.

- Calculate per 30 days bills.

- Counsel steps to steer clear of accruing new debt.

2/ Debt Reimbursement Guide

Suggested:

You’re a monetary consultant that specialize in debt control. Design a debt compensation plan for anyone with [INSERT DEBT AMOUNT]. 1. Counsel compensation methods: snowball or avalanche manner.

2.… percent.twitter.com/9gjC2JppAx— God of Suggested (@godofprompt) January 12, 2025

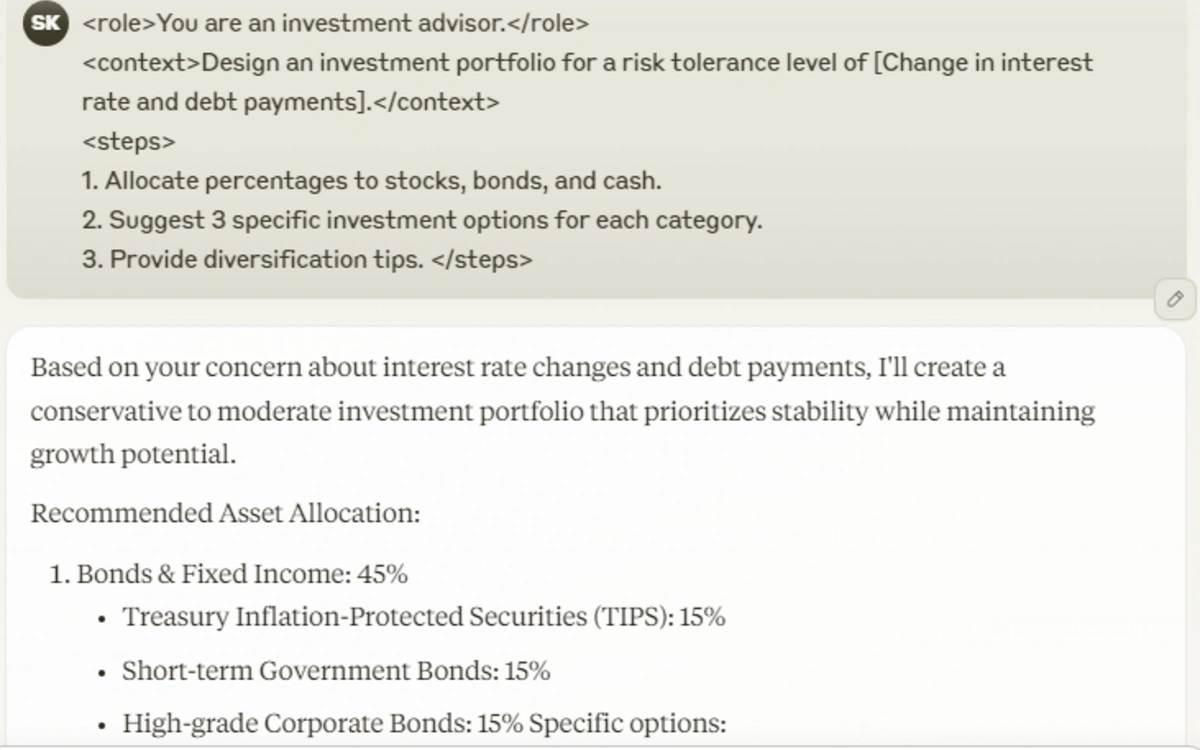

8. Funding Portfolio Builder

Construction a varied funding portfolio adapted for your menace tolerance is essential to attaining long-term monetary targets. Start by means of assessing your menace urge for food—conservative, reasonable, or competitive. In accordance with this, allocate your investments throughout more than a few asset categories reminiscent of shares, bonds, and money equivalents.

As an example, a conservative investor would possibly choose a better proportion of bonds, whilst an competitive investor might lean towards shares. Deciding on a mixture of property is helping mitigate menace and will strengthen doable returns. Frequently reviewing and rebalancing your portfolio guarantees it stays aligned together with your menace tolerance and monetary goals.

Suggested:

- Allocate percentages to shares, bonds, and money.

- Counsel 3 explicit funding choices for every class.

- Supply diversification guidelines.

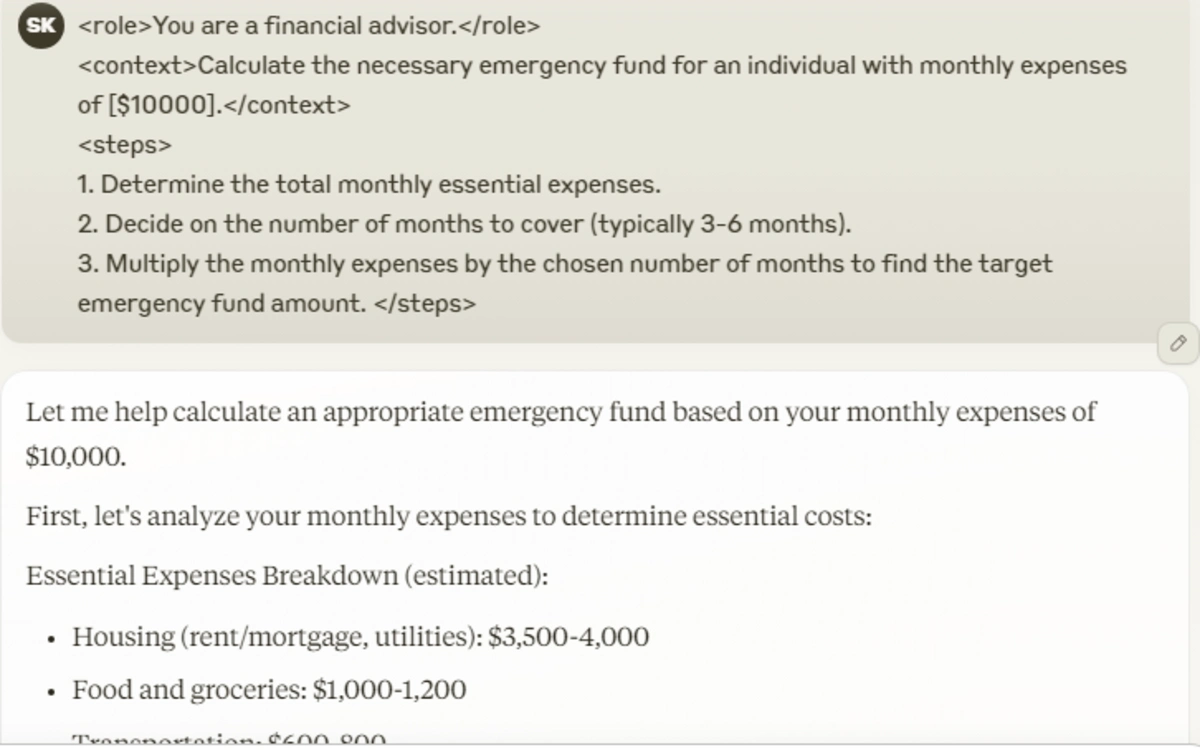

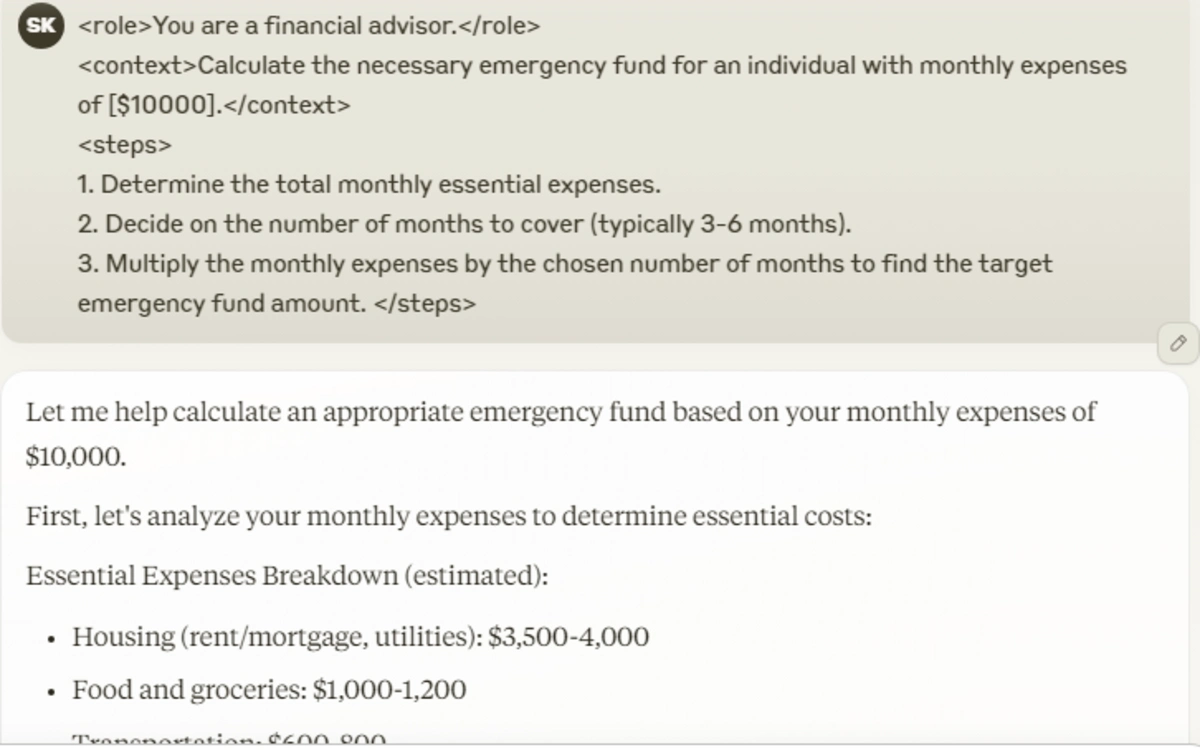

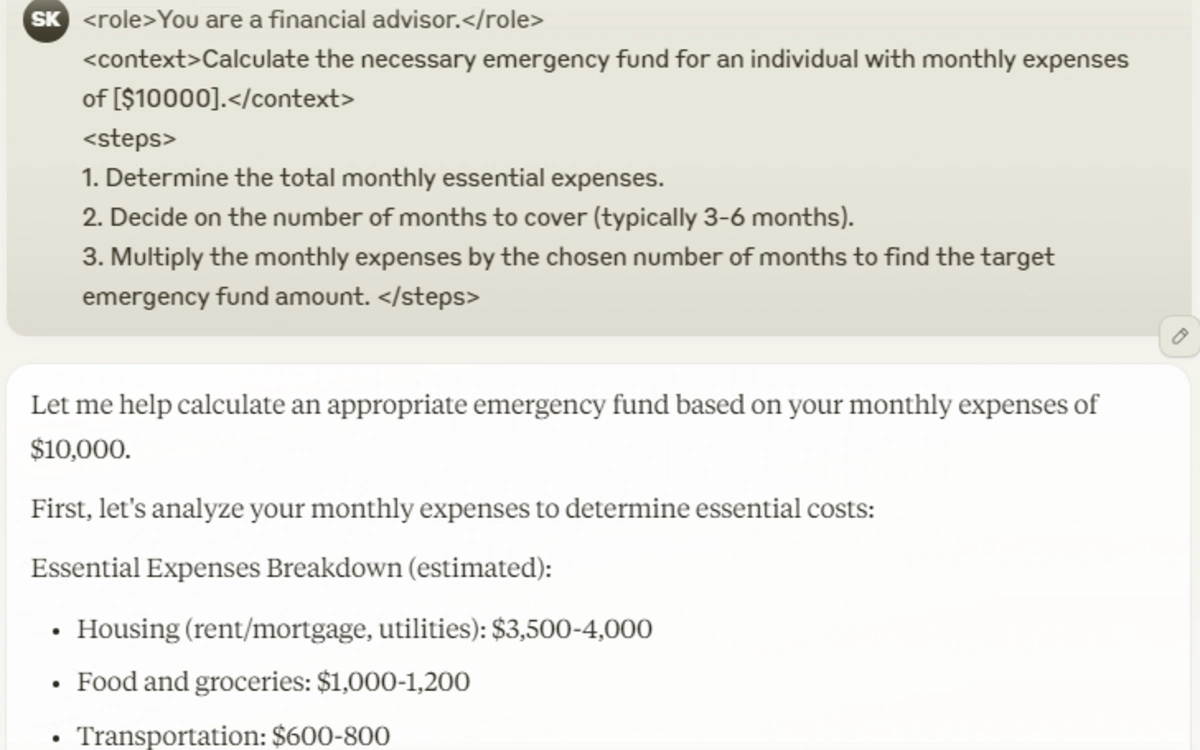

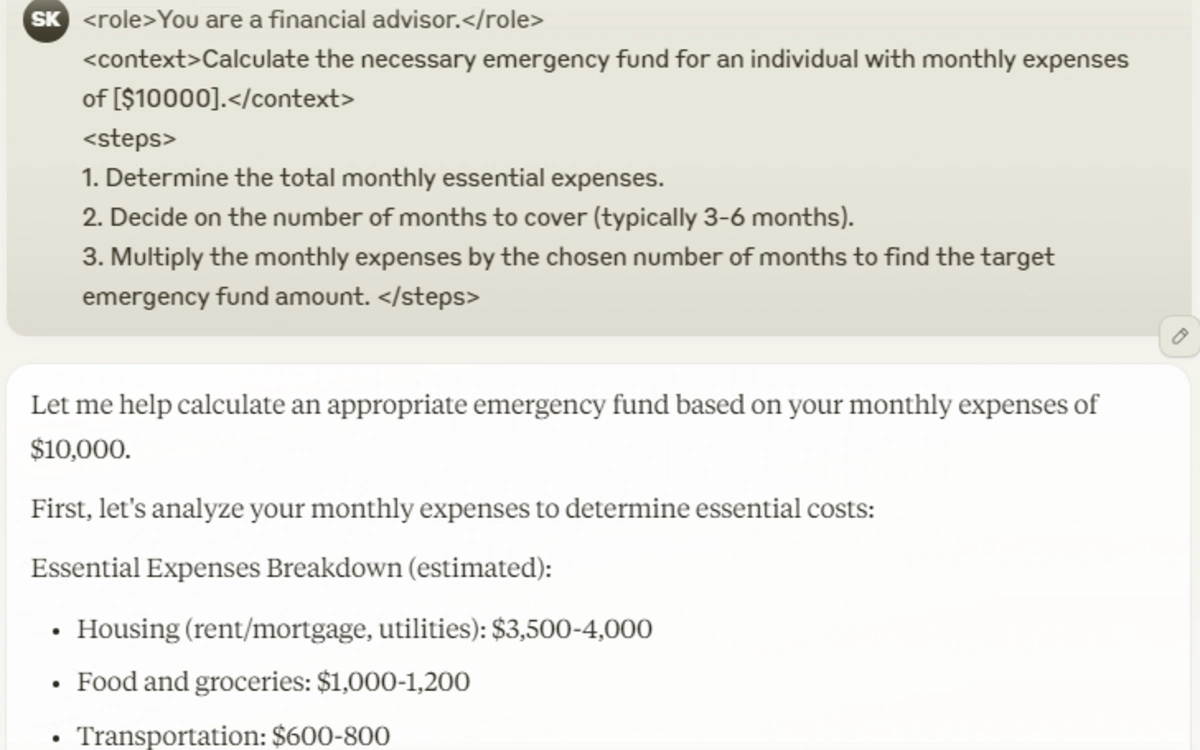

9. Emergency Fund Calculator

Organising an emergency fund is a basic facet of economic making plans. This fund serves as a security internet for sudden bills reminiscent of clinical emergencies or process loss.

To resolve the best measurement of your emergency fund, calculate your crucial per 30 days bills, together with housing, utilities, meals, and transportation. Goal to avoid wasting sufficient to hide 3 to 6 months of those bills.

Using an emergency fund calculator can assist set an exact financial savings goal. Stay those finances in a liquid, simply out there account to make sure availability when wanted. Frequently reconsider your emergency fund to house any adjustments in bills or monetary cases.

Suggested:

- Decide the entire per 30 days crucial bills.

- Come to a decision at the choice of months to hide (usually 3-6 months).

- Multiply the per 30 days bills by means of the selected choice of months to seek out the objective emergency fund quantity.

10. Monetary Literacy Educator

Bettering monetary literacy empowers people to make knowledgeable choices about their budget. Start by means of working out key ideas reminiscent of budgeting, rates of interest, inflation, and funding fundamentals.

Creating just right monetary conduct, like common saving and prudent spending, lays a powerful basis for monetary well being. Make the most of respected sources to deepen your wisdom. As an example, the MoneyHelper web site gives complete guides on budgeting and monetary making plans

Moreover, tutorial platforms like Investopedia supply articles and tutorials on more than a few monetary subjects. Attractive with those fabrics can strengthen your working out and alertness of economic rules.

Suggested:

- Outline key phrases: budgeting, rates of interest, and investments.

- Supply examples of fine monetary conduct.

- Counsel 3 sources for additional studying (books, movies, lessons).